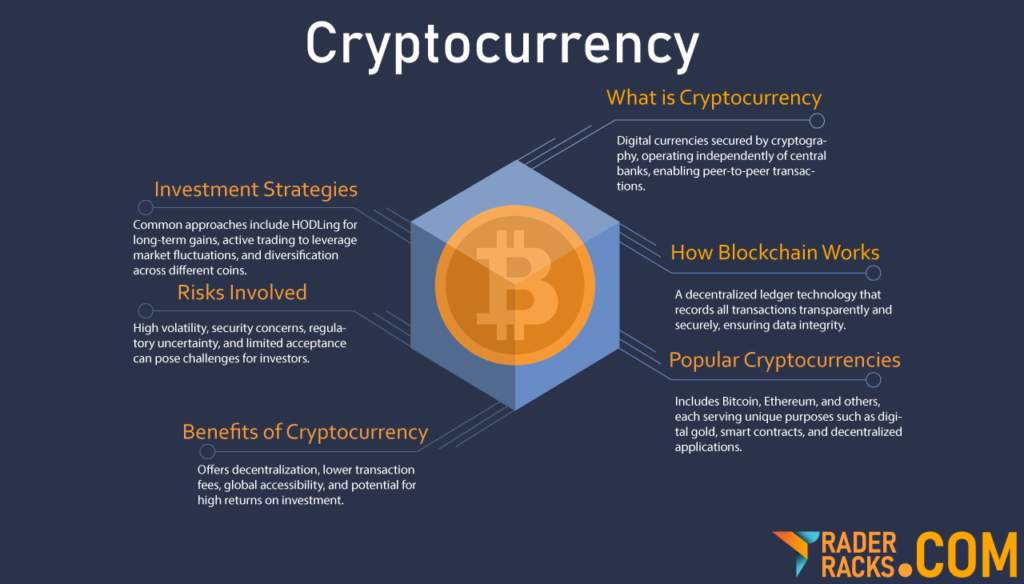

Cryptocurrency is a digital form of currency that uses cryptography for security, making it decentralized and free from control by governments or central banks. Unlike traditional currency, such as dollars or euros, cryptocurrencies operate on blockchain technology, ensuring transparency and security through a distributed ledger. While traditional currencies are issued and regulated by financial institutions, cryptocurrencies are peer-to-peer, meaning transactions occur directly between users without intermediaries like banks. This makes them unique, offering greater flexibility and global accessibility.

How Cryptocurrency Works

Blockchain Technology

Blockchain technology is the foundation of how cryptocurrencies work. It’s a decentralized, digital ledger that records all transactions across a network of computers, ensuring transparency and security. Each transaction is grouped into a “block” and linked to the previous one, forming a “chain.” This structure makes it nearly impossible to alter or tamper with data, providing trust and reliability without needing a central authority. Blockchain’s innovative design is what enables cryptocurrencies to operate in a secure, peer-to-peer manner.

The Role Of Miners And How Transactions Are Validated

Miners play a crucial role in validating transactions within cryptocurrency networks. They use powerful computers to solve complex mathematical problems, which helps verify and group transactions into blocks on the blockchain. Once a block is validated, it’s added to the chain, and the miner is rewarded with cryptocurrency. This process, known as mining, ensures the security and integrity of the network by preventing fraud and double-spending, while also maintaining the decentralized nature of cryptocurrencies.

Popular Cryptocurrencies

Overview Of Some Major Cryptocurrencies

Bitcoin (BTC): Bitcoin is the first and most well-known cryptocurrency, created in 2009 by an anonymous person or group known as Satoshi Nakamoto. It operates on blockchain technology, enabling peer-to-peer transactions without the need for a central authority, such as a bank. Bitcoin is often seen as “digital gold” due to its limited supply and has become a popular choice for both investors and those seeking an alternative to traditional currency. Its success has paved the way for many other cryptocurrencies in the market today.

Ethereum (ETH): Ethereum (ETH) is a leading cryptocurrency known for its smart contract functionality, which goes beyond simple transactions. Launched in 2015 by Vitalik Buterin, Ethereum allows developers to create decentralized applications (dApps) on its blockchain, making it a key player in the world of decentralized finance (DeFi) and NFTs. Unlike Bitcoin, which is primarily a digital currency, Ethereum’s blockchain supports a wide range of innovative applications, making it a versatile and highly valued platform in the cryptocurrency space.

Dogecoin (DOGE): Dogecoin (DOGE) started as a lighthearted, meme-inspired cryptocurrency in 2013 but has since gained a large and passionate community. Initially created as a joke, Dogecoin’s fun and approachable image quickly attracted attention, and it has become a popular digital currency for tipping online and small transactions. Unlike Bitcoin, which has a limited supply, Dogecoin has an unlimited supply, making it more accessible and inexpensive. Its rise in popularity, fueled by social media and celebrity endorsements, has turned it into a serious contender in the crypto space.

Beyond Bitcoin and Ethereum, several other major cryptocurrencies have gained significant traction in the market. Binance Coin (BNB), launched by the Binance exchange, is widely used for trading fees and has grown in value alongside the platform. Cardano (ADA) is known for its focus on sustainability and scalability, offering a robust platform for smart contracts and dApps. Solana (SOL) is praised for its high-speed transactions and low fees, making it popular for decentralized finance (DeFi) applications. Each of these cryptocurrencies offers unique features, contributing to the growing diversity of the crypto ecosystem.

Key Features And Differences Between Cryptocurrencies

Cryptocurrencies may share common features like decentralization and blockchain technology, but each has unique characteristics that set it apart. For example, Bitcoin is known for its simplicity and use as a digital store of value, while Ethereum offers smart contract capabilities, allowing developers to create decentralized applications. Solana focuses on high-speed, low-cost transactions, making it ideal for decentralized finance (DeFi), while Cardano emphasizes sustainability and scalability. These differences cater to various use cases, giving investors and users a range of options based on their needs and preferences.

How To Buy And Store Cryptocurrency

Setting up a digital wallet

Here is a really simple step by step process to Setup a Digital Wallet.

- Choose a Wallet Type: Decide between a software wallet (mobile, desktop, or web-based) or a hardware wallet (physical device). Software wallets are convenient for regular use, while hardware wallets offer extra security for long-term storage.

- Download or Purchase the Wallet: For software wallets, download a reputable app or program from the provider’s website or app store. For hardware wallets, purchase a trusted device.

- Create Your Wallet: Follow the on-screen instructions to set up your wallet. This usually involves creating an account and securing it with a password.

- Secure Your Private Key: You’ll be given a private key or a recovery phrase—store this safely and never share it. This is your only way to access your funds if you lose your password or device.

- Start Using Your Wallet: Once set up, you can generate a public wallet address to receive cryptocurrency, and you’re ready to buy, send, and store your digital assets securely.

Buying cryptocurrency through exchanges

When it comes to buying cryptocurrency, using an exchange is one of the most popular and straightforward methods.

- Choose a reputable exchange: Start by selecting a reliable cryptocurrency exchange. Some popular options include Coinbase, Binance, and Kraken. Make sure the platform supports the currency you want to buy and operates in your region.

- Create an account: Sign up by providing your personal details. You’ll typically need to verify your identity by submitting a government-issued ID and completing any other verification steps required by the platform.

- Deposit funds: Once your account is set up, deposit funds into the exchange. Most exchanges accept payments via bank transfer, credit/debit card, or other digital payment methods.

- Select your cryptocurrency: Browse the available cryptocurrencies on the platform, and choose the one you want to purchase, such as Bitcoin, Ethereum, or other altcoins.

- Place an order: After selecting the cryptocurrency, decide how much you want to buy. You can place a market order (buy at the current price) or a limit order (set a specific price at which you want to buy).

- Confirm and store your assets: Once your order is executed, the cryptocurrency will be deposited into your exchange wallet. For added security, consider transferring your assets to a private wallet, such as a hardware wallet, for long-term storage.

Security Tips For Storing Digital Assets

Protecting your digital assets is crucial to avoid potential losses from hacks or theft. Always use a secure wallet—hardware wallets like Ledger or Trezor are recommended for long-term storage as they keep your assets offline. Enable two-factor authentication (2FA) on your exchange and wallet accounts for added security. Regularly back up your private keys and store them in a safe place, never sharing them with anyone. Finally, stay vigilant against phishing scams and only interact with trusted, secure websites or platforms.

Major Benefits Of Cryptocurrency

Decentralization And Security

One of the key benefits of cryptocurrency is its decentralized nature, meaning it isn’t controlled by any single authority like a government or bank. This enhances security by distributing control across a vast network of computers (nodes), reducing the risk of manipulation or single points of failure. Additionally, transactions are secured through advanced cryptographic techniques, making them highly resistant to fraud and hacking, further safeguarding users’ assets.

Potential For High Returns

Cryptocurrency offers the potential for significant returns, attracting investors looking for growth opportunities. Digital assets like Bitcoin and Ethereum have experienced substantial price increases over time, often outpacing traditional investments. While the market can be volatile, those who time their investments well can see impressive gains. However, it’s important to approach with caution and research, as high rewards often come with higher risks.

Accessibility And Global Reach

Cryptocurrency offers unparalleled accessibility, allowing anyone with an internet connection to participate in the global financial system. Unlike traditional banking, which can be restricted by geography or regulations, cryptocurrencies enable borderless transactions, making it easy to send or receive money anywhere in the world. This is especially beneficial for the unbanked population and those in regions with limited access to financial services, empowering more people to engage in the global economy.

Ownership Control

With cryptocurrency, you have full control and ownership over your assets, without relying on intermediaries like banks or payment processors. Once you hold your private keys, you have direct access to your funds and can manage them independently. This eliminates the risks associated with third-party control, such as account freezes or transaction restrictions, giving you greater financial freedom and autonomy over your wealth.

Lower Transaction Costs

One of the key advantages of cryptocurrency is its ability to reduce transaction costs. Unlike traditional banking systems, which often involve hefty fees for international transfers or intermediaries, cryptocurrency transactions can be processed with minimal charges. This is particularly beneficial for cross-border payments, allowing users to send and receive funds quickly and affordably, without the overheads typically associated with financial institutions.

Risks And Challenges Associated With Crypto

Volatility and market fluctuations

Cryptocurrency markets are well known for their high volatility, with prices often experiencing dramatic swings in short periods. While this volatility can present opportunities for significant gains, it also poses substantial risks, especially for inexperienced investors. Factors like market sentiment, regulatory news, and technological developments can trigger sudden price fluctuations. It’s essential for anyone involved in cryptocurrency to be prepared for these ups and downs and approach the market with a long-term strategy or risk management plan in place.

Security Concerns And Scams

These are the real challenges in the cryptocurrency space, but with the right precautions, you can protect your assets. Hackers and scammers often target wallets, exchanges, and unsuspecting investors, so using secure wallets, enabling two-factor authentication, and sticking to trusted platforms are essential steps. Be cautious of phishing schemes and too-good-to-be-true offers, as scams are common. Staying informed and proactive helps ensure your crypto journey stays safe and worry-free.

Regulatory Issues And Legal Considerations

Regulatory issues and legal considerations play a big role in the evolving world of cryptocurrency. Since crypto laws vary across countries, staying aware of local regulations helps you avoid legal trouble and ensures your investments remain compliant. Governments may introduce new policies, like tax requirements or trading restrictions, so keeping up-to-date with these changes is essential. Working with reputable exchanges and consulting experts when needed can give you peace of mind while navigating the legal side of crypto investing.

Limited Acceptance

Limited acceptance is still a challenge for cryptocurrencies, as not all businesses or platforms are ready to embrace them as a payment method. While major coins like Bitcoin and Ethereum are gaining traction, many retailers and service providers stick to traditional currencies. This can make it tricky to use crypto in everyday transactions. However, as awareness grows and more companies adopt blockchain solutions, acceptance is gradually improving. Staying patient and prepared for these shifts will help you make the most of your crypto investments in the long run.

Cryptocurrency Investment Strategies

Long-Term Holding Vs. Trading

- Long-Term Holding

Often called “HODLing,” is a popular cryptocurrency investment strategy focused on purchasing a set of assets and keeping them for a long period, regardless of market volatility. The idea is to withstand short-term price fluctuations and benefit from potential long-term growth as the crypto market matures. This strategy requires patience and a belief in the fundamental value of the chosen assets, making it ideal for investors aiming to avoid the emotional pitfalls of frequent trading. With the right mindset, long-term holding can unlock significant returns over time, especially in emerging markets like blockchain technology.

- Trading

Actively buying and selling digital assets to capitalize on short-term price movements. Unlike long-term holding, trading requires constant market analysis, quick decision-making, and a solid understanding of technical indicators. Traders use strategies like day trading, swing trading, or scalping to maximize profits within short time frames. While it offers the potential for quick returns, trading also carries higher risks and demands discipline, time, and experience to succeed in the fast-paced crypto market.

Diversification Across Different Cryptocurrencies

This is like spreading your eggs into multiple baskets—it reduces risk while increasing your chances of benefiting from various market trends. Each cryptocurrency has unique features, use cases, and growth potential, so investing in a mix, like Bitcoin, Ethereum, and emerging altcoins, helps balance rewards and volatility. This strategy ensures that if the value of one coin drops, others might still perform well, keeping your investments on a steady path. Honestly Diversification isn’t just smart—it’s a way to explore the crypto world without putting all your hopes on a single coin.

Risk Management Techniques

These are essential to navigating the ups and downs of cryptocurrency markets. Strategies like setting stop-loss orders, only invest what you can afford to lose, and regularly re-balancing your portfolio help protect your investments from unexpected market swings. Diversifying assets and staying updated on market trends also minimize exposure to risk. By managing risk wisely, you can make more confident decisions and stay in control, even when the market gets unpredictable.

Practical Tips For Beginners

Start With Small Investments

It’s one of the smartest ways to start in the world of cryptocurrency for beginners without feeling overwhelmed. It allows you to learn the ropes, understand market movements, and build confidence at your own pace. Since the crypto market can be unpredictable, investing small amounts also helps limit your risk while you develop your own strategies. As you gain more experience, you can gradually increase your investments and implement different strategies. Always remember, even small steps can lead to big rewards over time!

Do thorough research

Doing deep research is key to making smart cryptocurrency investments. With so many coins, platforms, and trends out there, taking the time to understand a project’s purpose, technology, and team can help you make informed decisions. Don’t just follow hype—look into market performance, community feedback, and future potential. The more you know, the better prepared you’ll be to spot opportunities and avoid unnecessary risks. In crypto, Having a proper knowledge really is a powerful tool!

Stay Up To-Date With Market Trends

Being updated with market trends is really essential in the fast-moving world of crypto. Prices can change quickly based on news, technological developments, or regulatory updates, so keeping an eye on the latest trends helps you make timely decisions. Following trusted crypto news sources, joining online communities, and tracking market data can give you valuable insights. The more current you are, the better you’ll be at spotting opportunities and managing risks.

Keep a Long-Term Perspective

Keeping a long-term perspective is essential when investing in crypto, as the market can be highly volatile in the short run. Instead of reacting to every price swing, focus on the bigger picture and the potential growth of your chosen assets over time. Patience helps you avoid emotional decisions like panic selling or chasing trends. Many successful investors hold onto their investments through ups and downs, giving their portfolios time to grow. Remember, crypto is a marathon, not a sprint!

What’s The Future of Cryptocurrency

Emerging Trends And Technologies

Everyday new trends and technologies are shaping an exciting future for cryptocurrency. Innovations like decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based gaming are expanding the ways people use digital assets. New developments, such as central bank digital currencies (CBDCs) and advancements in scalability solutions, could further drive adoption. Staying curious and informed about these trends helps you spot early opportunities and better understand the direction the crypto space is heading.

Potential Impact On Global Finance

Crypto has the potential to reshape the world of global finance by making transactions faster, cheaper, and more accessible. With decentralized systems, people can send money across borders without relying on traditional banks. Cryptos like Bitcoin are also being considered as stores of value, similar to gold, while stablecoins offer a new way to manage digital payments. As more industries and governments explore blockchain technology, we could see a shift toward more inclusive financial systems, empowering individuals and businesses worldwide.

Additional Resources

Books:

- “The Bitcoin Standard” by Saifedean Ammous

A great introduction to Bitcoin’s history and significance in the global financial system.

- “Cryptocurrency: How Bitcoin and Digital Money are Challenging the Global Economic Order” by Paul Vigna & Michael Casey

A deep dive into the impact of cryptocurrencies on the economy.

- “Mastering Bitcoin: Unlocking Digital Cryptocurrencies” by Andreas M. Antonopoulos

A bit technical, but perfect for beginners looking to understand Bitcoin’s mechanics.

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske & Jack Tatar

Covers how to analyze and invest in a variety of crypto assets.

Online Courses:

- Coursera – Bitcoin and Cryptocurrency Technologies

Princeton University offers this course to explain the basics of blockchain and crypto.

- Udemy – Cryptocurrency Investment Course 2024

Fund Your Retirement!: Ideal for beginners with actionable tips for crypto investments.

- edX – Introduction to Blockchain and Cryptocurrencies

Offered by Berkeley, it covers crypto fundamentals in a structured way.

- Binance Academy

Free educational platform offering lessons on blockchain, trading, and cryptocurrencies.

Other Resources:

- Podcasts

- “The Pomp Podcast” by Anthony Pompliano,

- “The Bad Crypto Podcast”

- “Unchained”

- “Crypto 101 Podcast”

- Youtube Channels

- “Coin Bureau” Provides in-depth analysis and crypto news in an easy-to-understand manner.

- “Andreas M. Antonopoulos” One of the leading experts on Bitcoin, with many educational videos for beginners.

- “Benjamin Cowen” Focuses on data-driven crypto market analysis and long-term strategies.

- “Altcoin Daily”

KEY TAKEAWAYS

- Blockchain acts as a decentralized source for secure and transparent transactions; miners validate transactions and maintain network integrity.

- Bitcoin (BTC) is viewed as “digital gold”; Ethereum (ETH) supports smart contracts and dApps; Dogecoin (DOGE) is community-driven for small transactions; other notable coins include Binance Coin (BNB), Cardano (ADA), and Solana (SOL).

- Crypto had two kind of wallets software and hardware, and they completely depends on user needs.

- Benefits include decentralization, a great potential for high returns, global access, user ownership, and low transaction fees provided by different platforms.

- Risks involved in cryptocurrency are price volatility which causes because of regulatory news, technological advancement, security threats, and limited business acceptance.

- Investment strategies included in crypto are HODLing for long-term growth, active trading, diversifying the investment portfolio across different cryptocurrencies, and effective risk management.

- As a beginners you should start small, research thoroughly, stay updated on market news and trends, and focus on long-term potential instead of just thinking about the short term benefits.

Conclusion

Exploring cryptocurrency can be an exciting journey, but it’s important to approach it responsibly. Start small, do your research, and take time to understand the risks and rewards involved. Crypto markets can be unpredictable, so having a clear plan and managing your emotions will go a long way. Focus on learning, stay curious about emerging trends, and always invest within your comfort zone. With patience and responsibility, crypto investing can become a rewarding experience, opening doors to new financial opportunities. Remember, every expert was once a beginner—take it step by step, and enjoy the learning process.

Frequently Asked Questions

Is cryptocurrency a good investment for beginners?

While it offers high returns, crypto investments are highly volatile, so beginners should proceed cautiously and diversify their portfolio.

Which cryptocurrency should I invest in as a beginner?

Bitcoin (BTC) and Ethereum (ETH) are safer beginner options due to their stability and market dominance.

How much money should I invest in cryptocurrency?

Only invest what you can afford to lose, ideally starting with small amounts to minimize risk.

What are the best platforms or exchanges for beginners?

Coinbase, Binance, and Kraken are user-friendly and reliable for beginners.

What is the difference between a hot wallet and a cold wallet?

Hot wallets are online and easy to access; cold wallets are offline and offer better security.

Do I need to pay taxes on cryptocurrency gains?

Yes, crypto gains are taxable in most countries, and you must report them as capital gains or income

What is the difference between Bitcoin and altcoins?

Bitcoin is the first cryptocurrency, while altcoins refer to all other cryptocurrencies like Ethereum and Litecoin.

What are stablecoins, and should I invest in them?

Stablecoins, like USDT, are pegged to fiat currencies and provide stability in volatile markets.

How do I avoid scams and fraud in the crypto space?

Avoid unsolicited offers, verify token legitimacy, and stick to trusted exchanges.

What are gas fees, and why are they important?

Gas fees are transaction costs on blockchain networks, especially on Ethereum, to process transactions.

What is the difference between centralized and decentralized exchanges?

Centralized exchanges (CEX) are user-friendly but custodial, while decentralized exchanges (DEX) give you full control of your assets.

How do I track the performance of my crypto investments?

Use tools like CoinMarketCap or CoinGecko to monitor market trends and portfolio performance.

What is staking, and how can I earn rewards from it?

Staking involves locking your crypto to support a blockchain network and earn passive rewards.

Is it too late to invest in Bitcoin?

No, Bitcoin still holds long-term growth potential, though it’s best to research market trends before investing.

ARTICLE SOURCES

- CoinMarketCap. “Today’s Cryptocurrency Prices by Market Cap.”

- Binance. “New Cryptocurrency.”

- U.S. Securities and Exchange Commission. “Crypto Assets.”

- Blockchain.com. “Bitcoin Explorer.”

Author

Waqas Abdul Hakeem Personal Finance Expert

A passionate personal finance expert and affiliate marketer dedicated to linking consumers with valuable products, services, and content. Specializing in affiliate and personal finance, I craft engaging content supported by thorough research and data-driven strategies. With a commitment to transparency and integrity, I strive to build trust with readers and empower them to make informed financial decisions.